The market for plant-based meat alternatives offers enormous potential. Arguably, the Corona pandemic has a catalytic effect on this development. Start-ups and large corporations are in the starting blocks. Are plant-based alternatives ready for the mass market?

They are now part of the menu at many barbecues: meatless burgers made from pea protein, wheat or soy. Today’s alternative protein products look, smell, and yes, (in some cases) taste like the classic ground beef patties.

Beyond Meat has shown how it can be done: in recent months, the start-up tripled its sales in supermarkets compared to the previous year. During Corona lockdown, the company sold more plant-based burgers than ever before. There’s also a chance for excellent investment returns in the plant-based food space. And the large once a slowly following.

Mass product in the supermarket

The Corona crisis increased the appetite for plant-based alternatives; often, meat substitutes for many consumers. In general, people became more aware of their health – and understanding better what they eat. Already now, consumers can choose from a considerable number of plant-based meat substitutes in many supermarkets. Quick Service Restaurants have also added new-generation plant-based alternatives to their menus, making them an essential channel for manufacturers to reach a broader range of consumers.

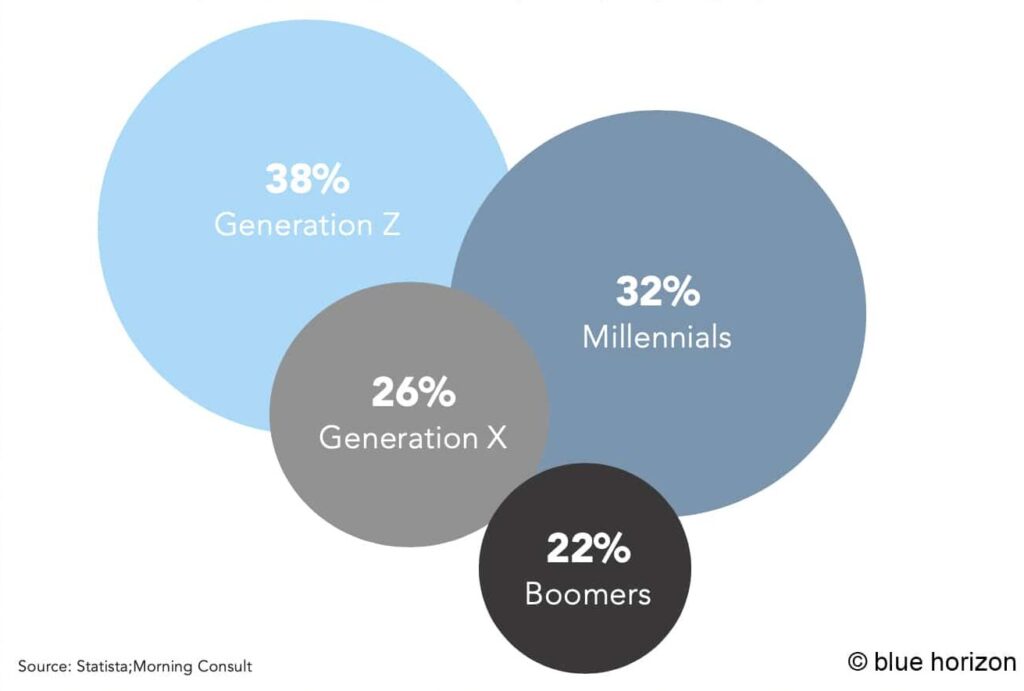

Share of consumers buying more healthy food due to COVID-19 in the U.S.

There is and needs to be, a clear path to the mass market consumption. The question is: will consumers regularly consume and repeatedly buy these next-gen products in the future? Björn Witte, Managing Partner and CEO of the Swiss impact investor Blue Horizon, sees two hurdles in particular that still need to be overcome: “The taste still has to improve, and the price has to come down.”

Taste and price are key

Many people like the taste of meat, as they have been told for decades. However, since the awareness of sustainability, health and animal welfare continues to grow, the proportion of flexitarians and vegetarians is steadily increasing. The catch-up needs to happen on pricing and taste.

"In terms of taste, a lot has happened in the past twelve to eighteen months. The burger from Beyond Meat is not yet an iPhone 11, but at least an iPhone 4, while a Quorn schnitzel is more like a Nokia."

Björn Witte

Same with pricing. As long as plant-based substitutes are still more expensive than the cheapest conventionally produced meat, vegan offerings will only change consumer behaviour to a limited extent. But as soon as plant-based proteins start reaching a price parity, we will experience a proper re-shuffle of cards – and the innovation destined for a disruptive breakthrough.

Meat alternatives are good for the environment

The advantages of meat substitutes are apparent: If we can take the animal out of the food chain, every single consumer can make a significant contribution to sustainability, whether it’s climate protection or land and water consumption. Consumers are also becoming increasingly aware of such connections.

In a recent study, Blue Horizon calculated the differences in environmental costs between conventional meat and plant-based alternatives. According to the study, a plant-based burger causes one-sixth of the environmental costs – in terms of greenhouse gas emissions and land/ water consumption – compared to a conventional beef burger produced in Europe. Although plant-based alternatives are also far better than meat produced in an organic process, the key target market for replacement is the most non-organic mass market.

Dynamic competition

The race to see who will conquer the mass market has only just begun. It won’t be a “winner takes it all” market, but dominant players will emerge over time. Start-ups like Beyond Meat have so far scored with innovative approaches, and companies like the Livekindly co. are showing the way. Clearly, the large conglomerates like Nestlé are also waking up – but plant-based food will always only be one of their niches.

Thanks to new production technologies and larger sales volumes, meat substitutes’ unit costs will fall in the coming years. Simultaneously, conventional meat is likely to become more expensive as environmental costs such as CO2 emissions and water usage will increasingly have to be factored into the price. The alternative protein market is where the action is in the next decades to come.

Source: Blue Horizon, NZZ,

Blue Horizon Corporation shapes the market’s growth for alternative proteins since the beginning and accelerates it through targeted investments being a pure-play industry pioneer. The company aims to sustainably transform the global food industry through investments in companies who are replacing animal proteins with healthy, alternative protein sources across the global supply chain. Blue Horizon was founded in 2016 and is based in Zurich. The company launched its first venture fund in 2018. Since then, it has completed over 50 seed and venture capital investments in the alternative protein food tech sector and raised more than CHF 500 million. Its business model offers unique market access from Seed to Consolidation via funds and direct investment platforms throughout all stages of asset lifecycles.

More on www.bluehorizon.com