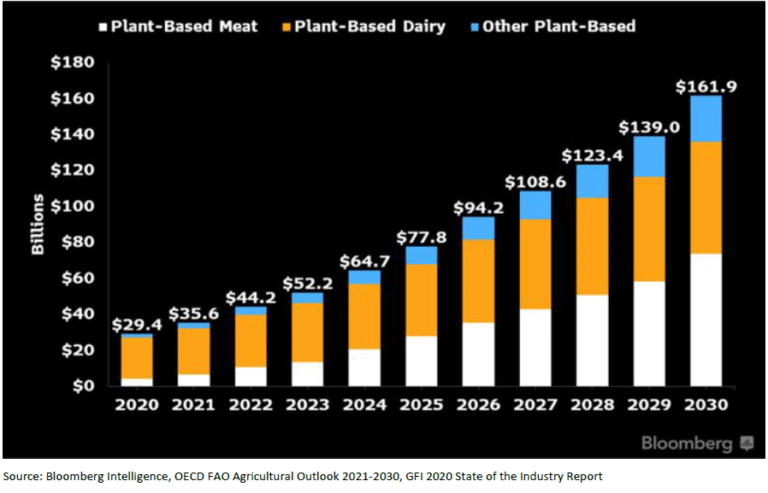

According to Bloomberg Intelligence’s report “Plant-Based Foods Poised for Explosive Growth,” global retail sales of plant-based food alternatives might reach $162 billion by 2030, up from $29.4 billion in 2020. The worldwide plant-based food market would account for 7.7% of total protein consumption with that percentage. Milk/dairy and meat, the two main subcategories of plant-based alternatives, will continue to dominate sales in the market.

Food-related consumer habits often come and go as fads, but plant-based alternatives are here to stay — and grow. The expanding set of product options in the plant-based industry contributes to plant alternatives becoming a long-term option for consumers around the world. If sales and penetration for meat and dairy alternatives continue to grow, our scenario analysis suggests that the plant-based food industry has the potential to become ingrained as a viable option in supermarkets and restaurants alike. Meat and dairy alternatives could obtain 5% and 10% of their respective global market shares in the next decade.

Plant-based meat alternatives

Bloomberg Intelligence shows that the worldwide plant-based alternative meat market might reach $28 billion by 2025. This may result in a $74 billion potential by 2030 if plant-based milk sales growth and penetration levels match those of plant-based milk and reach 5% of the total meat and fish market. In 2020, plant-based meat represented only 0.3% of overall meat sales, but growth is rising as products become more widely available, customer knowledge develops, prices fall, and the perceived health and sustainability benefits gain traction. If these dynamics accelerate faster than projected, plant-based meat retail sales might reach $118 billion by 2030. Slower adoption, hampered by regulatory concerns and supply limits, might result in a $37 billion market.

Growth in plant-based alternative meat products will be driven chiefly by buyers looking to replace meat proteins with something believed to be healthier. According to the Good Food Institute, Americans who eat a flexitarian diet — predominantly vegetarian with occasional meat and fish — account for up to one-third of the population and are an important demographic for plant-based meat replacements. Households that prefer meat alternatives are more likely to have children, be college-educated, and earn more than $50,000 a year.

If sales growth and penetration levels follow the route of plant-based milk, the plant-based alternative meat market can develop greatly in size. Alternative meat accounts for less than 1% of overall meat category sales; however, plant-based milk has increased to nearly 15% of total milk sales since added to dairy cases makes it more visible to customers. Improved flavour, more availability, and the inclusion of plant-based alternatives in grocers’ refrigerated meat aisles should all contribute to a comparable boom in consumer adoption and sales growth.

Furthermore, closing the price gap between higher-priced plant-based alternatives and conventional meat products will substantially stimulate increased plant-based meat consumption. According to Bloomberg Intelligence, both raw material and manufactured product supplies are improving, promoting plant-based substitute meat sales. Scale is critical since more significant production quantities will assist cut prices, which will help shrink the price gap with conventional proteins and aid long-term adoption. In recent years, important participants in the worldwide plant-based protein market, including Archer Daniels Midland, Cargill, Roquette, Ingredion, Glanbia, and Kerry Group, have developed their plant-protein capabilities.

Following Bloomberg Intelligence, alternative milk is the most crucial component of the plant-based dairy sector, accounting for over 75% of sales. This is a considerably more developed category now, following the rapid adoption of Danone’s Silk soy milk in the refrigerated milk case in 1999. Danone, Hebei Yangyuan, Blue Diamond, Coconut Palm Group, and Vitasoy are the market leaders in substitute milk. These corporations have extensive distribution networks, allowing their products to be easily accessible. New formulations, like oat milk, which boasts better sustainability benefits and a neutral flavour, propel startups like Oatly.

Growth factors

Aside from plant-based meat and dairy, plant-based condiments and dressings, as well as eggs and other goods, are still in their infancy, according to the report. These goods can expand to $25.7 billion in 2030, up from $2.3 billion in 2020.

Demographic and industrial drivers could assist accelerate the expansion of plant-based alternatives and distinguish the category as a long-term trend rather than a fad. This includes expanding retail distribution points, increased consumer interest in healthier lifestyles, more consistent supply as companies improves forecasting and manufacturing capabilities, increased raw material availability, achieving price parity with conventional products, and ongoing restaurant trials.