A most recent study shows that the U.S. retail demand in plants increased by 27 per cent last year, almost double the annual sales of retail food.

In 2020, plant-based food products grew strongly and in a sustainable manner. The latest figures published by Good Food Institute and PBFA indicate that overall plant retail sales amounted to $7 billion over the previous year and increased by 27 per cent – about two times as fast as total retail food sales in the United States. Plant-based food “dollars” increased by 43 per cent between 2018 and 2020 compared with a 17 per cent increase over the same timeframe over the overall U.S. food retail sales.

The Good Food Institute (GFI) published data claiming that the rise in investment means “an increasing demand for climate-friendly investments.” The report showed that last year, $2.1 billion in funding was made available to plant-based meats, eggs and milk businesses. Industries have raised just USD 667 million for 2019, which tripled that year’s capital gains.

Plant meat sales in 2020 amount to $1.4 billion

The plant meat segment passed the billion-dollar threshold in 2020 and by the end of the year reached $1.4 billion in sales. As in past years, much of this growth was driven by refrigerated plant-based meat, taking an increasingly larger share of the plant-based meat category.

Though plant-based burgers remained the most common plant-based meat food format in terms of dollar revenue, plant-based grounds became the game-changer. Plant-based ground sales more than doubled in size by 2020, thanks in part to the introduction and expanded availability of such items in store. Product formats such as deli slices and bacon are still comparatively minor subcategories, indicating room for advancement and expansion in these regions.

Plant-based milk, eggs, and dairy continue to expand rapidly.

Plant-based milk retained its position as the most significant plant-based product segment, with sales rising by 20% year on year to $2.5 billion. While almond milk remains the most common plant-based milk, oat milk has grown dramatically in the last two years. Oat milk, which was once a minor player in the plant-based milk industry, has grown to become the second-largest plant-based milk subcategory. This renewed interest in oat milk has spilt over into other plant-based dairy segments, with a slew of new plant-based yoghurts, ready-to-drink drinks, and creamers using oat milk as a basis. Plant-based ice cream and plant-based yoghurt each grew at 20 per cent throughout 2020. Plant-based eggs rose 168 per cent last year and 706 per cent over the past two years.

Inclusion increased for young, educated and higher-income customers

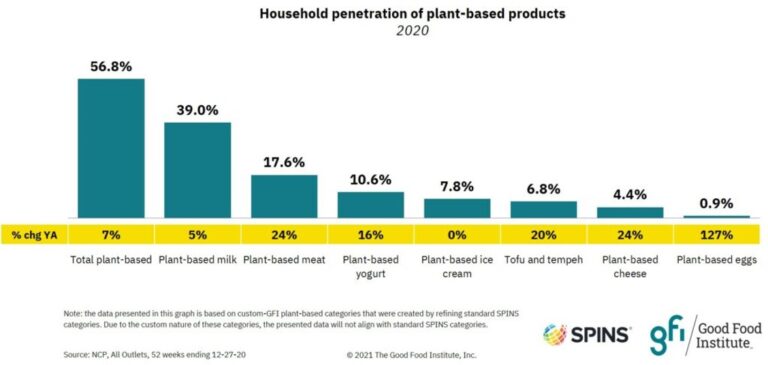

Household penetration in all plant-based food groups rose by 3.4 percentage points to 56.8 per cent in 2020, equal to nearly 73 million U.S. households. Plant-based meat household penetration rose by 3.4 percentage points to 17.6 per cent, implying that almost 23 million U.S. households will purchase plant-based meat in 2020, a 24 per cent rise from 2019.

Who is behind this increased spending? Plant-based customers are typically wealthier, from higher-income families, and have undergraduate or doctoral degrees. They still have children and are more likely to be people of colour. In terms of dollar indices, these demographic patterns often have elevated engagement levels between customers ages 35 to 44, graduated consumers and consumers with income above $100,000.

Plant-based products aren't just a trend; they're here to stay

A younger customer base is a hopeful indication that the plant-based food industry continues to achieve growth. When plant food prices decrease over time and continue to match prices with animal goods, then it is entirely possible that also customers purchase plant-related products from lower incomes.

These data together indicate that the plant-based food industry has substantial drive and development opportunities. See GFI’s industry study for more information on speedy and nutritious plant-based food development in 2020.

Source: GFI market research: U.S. retail market data for the plant-based industry

Further interesting articles